Learn How to Fix Your Credit Score Today

Do you have an 850 credit score or do you at least have really, really amazing credit? If you do, awesome. I’m proud of you. Way to go! But if you don’t have a credit score that’s as high as you want it to be, then listen up because I’m going to teach you the basics to understanding credit and credit repairs.

If we’ve talked about assets and liabilities and we’ve talked about acquiring real estate and stocks and all these things, and if we’ve talked about how to gain massive financial success, in order to do all those things in this day and age in the United States or most of the world, you must have great credit. I’m going to teach you about the way credit repair works in the United States.

Now, these are one of the few episodes that don’t necessarily apply internationally, so I apologize for the international listeners. But for the United States, I’m going to teach you how credit works and how you can repair your credit.

Understanding How Your Credit Score Works

Number one, there are three credit bureaus. These three companies are the ones tracking your credit. One is called Experian, the next is called Equifax, and the third one is called TransUnion. Why are there three? Well, it’s kind of like having three judges in a contest.

There are three different companies that are completely separate from one another, keeping track of your credit, and they all have different scores on you. When you go buy a car, often they’re going to pull one of those. When you go to buy a house or you try to make some bigger purchases, many of them will actually run multiple credit bureau reports, but the key is they’re all keeping scores on you.

Let’s understand this whole score system. The scores range from somewhere around 309 to about 893. Let’s just simplify that and say you go from somewhere in the low 300’s to the high 800’s, close to 900. So what does your score mean?

Well, I would say a score of about 309 to about 599 – anything less than 600 would be a bad credit score. By the way, that’s 24% of the people in the US. One out of every four people in the United States has bad credit; they’re under 600.

If you have a score between 600 and 699, then that means I’d say your credit is getting there. That’s about 21% of Americans, meaning one out of every five people has a credit score somewhere in the 600’s, and you’re getting there.

At that kind of credit score, you can actually qualify for certain things. You can definitely buy a car. You can get some credit cards and stuff like that, but you’re not quite at the level where you’re getting whatever you want.

The next level is from about 700 to 749, and that’s about 14% of Americans. These people have what I would call a good credit score: above 700, below 749. At this level, you can pretty much qualify for just about anything.

You’re going to get good interest rates, you’re going to be able to get good credit cards, you’re going to be able to get big credit cards if you want, you’re going to be able to buy stuff and get loans without much of a hassle.

The next level up would be anyone with a credit score over 750, and that is people with outstanding credit, and that’s where about 41% of people fall, believe it or not, is above a 750 credit score.

So wherever your credit score is, I want to teach you today how you can get your credit score to go up. Some of them are things you’ve already heard before; some of them are going to be life-changing for you. First of all, let’s talk about what is bad credit.

Things That Damage Your Credit

What damages your credit? Anytime you have a late payment, that damages your credit. Anytime you don’t pay something and it’s charged off, meaning you didn’t pay your electric bill and then the electric company finally stopped trying to collect from you, that’s bad because it’s a charged-off account.

Here’s one that many people don’t know about: if you have a balance of over 50% on your credit cards. See, credit bureaus and other credit companies don’t want to see you using up all of your credit.

So if you’ve got a $10,000 limit on a card, they don’t want to see that you’re using $5,000, $6,000, $7,000, $8,000, $9,000, or $10,000 of it. They want to see that you’re only using $1,000 to $4,000. That tells them that hey, this person is not overextending themselves and it shows that you have some control.

One rule that I personally follow is I think of my credit cards as being full if they reach 50%. Now, personally I’d say don’t use credit cards unless you have to, but credit cards are not a way of borrowing money.

Really, it’s just the credit cards can be a way for you to make transactions easier, but you should not be borrowing from credit cards for the long term. That’s a whole separate topic for another time.

Finally, the other thing that could damage your credit is too many inquiries. When you’re going to buy a car, for example, if you go to six different car lots, you don’t want all of them to run your credit.

You don’t want to be constantly applying for things where they’re running your credit because every time someone does an inquiry, it’s a dent on your credit. Now, one or two is okay but once you start getting up to five to 10 inquiries in a six-month period, that gets really, really bad. You don’t want that.

Tips for Fixing Your Credit Score

So what if you have some of these things? What if you’ve got some charged-off accounts, you’ve got some late payments, high balances – things like that.

What do you do? Well, the first thing to do is the basics. Obviously, if you’ve got a balance over 50% get it to under 50%.

In fact, if you’ve got multiple credit cards – sometimes, please have this one credit card that’s one of three or four that they have. The one that they use all the time has a balance of over 50% but some of the other ones are empty.

Well, one thing you can do is even out those balances so that none of them are over 50%. That can be huge. Another one is, of course, pay your bills on time, and if you’re late, make sure you at least get them paid within 30 days.

Once you hit that 30-day late mark, that’s when it gets reported to the credit agencies, so be careful to never, ever, ever, ever let anything be more than 30 days late. Ideally, don’t let it be late at all and pay it on time.

Now, what happens if you’ve got some things that are in your past? Often when I talk to people and they run their credit, almost always they find a bunch of stuff that’s on their credit that’s completely inaccurate or things they didn’t even know about.

They find for example a phone bill where some phone companies – they moved out of an apartment or something – they had like an $18 bill. I’ve literally seen this. For $18, this company sent them to collections but the collections people couldn’t get a hold of you and for $18, you can see why they might not try very hard.

Eventually, that thing got sold to different collection agencies and then finally it got charged-off and you look at it. These people have like three or four dings on their credit – massive dings for a charged-off account – over $18, and you may not have even owed the $18.

The key is a lot of you, if you don’t have great credit, often a lot of it isn’t even your fault. But you’ve got to go back, run your credit, and then there’s a method in which you can go about disputing these things and getting them off of your credit.

Anything that’s negative, a charged-off account, a late payment – any of that stuff – you can go in there if it’s inaccurate and get it taken off.

How to Dispute Negative Marks on Your Credit Score

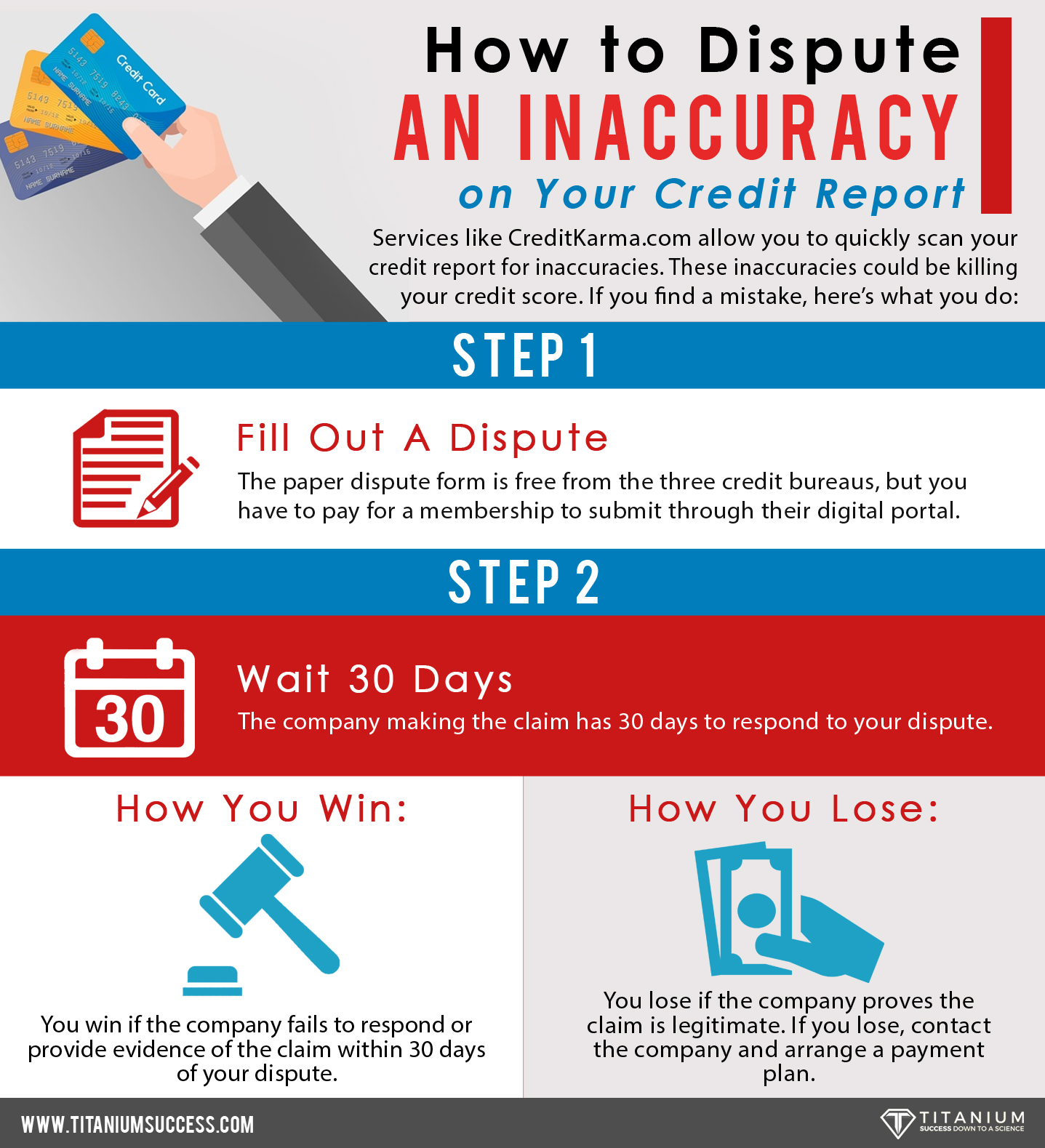

How do you do that? Simply the easiest way of doing it is going to cost you about $30 a month, because Experian, Equifax, and TransUnion each offer an online portal where you can go, sign up, and not only will they give you your credit score, but they also have an online dispute submission process in place where you can quickly dispute things.

Now, technically you could do this all for free and you can write in and do all this stuff, but the way I’m going to teach you to do it if you can afford the $30 a month, this is the best way of doing it.

You sign up for each of their simple, basic accounts. I believe they’re about $10 and it could change a little bit, but about $10 a month each, and then you can submit disputes. I would never submit more than three disputes in a single month.

But you can go on your credit, find some of these things that are negative that you want to dispute, and then you go on there and write the reason why it’s incorrect.

For example, it says you paid a credit card late but you know you didn’t, go on there. Write, “I didn’t pay this thing late. I paid it on time. I’m not sure why it says it’s late.”

If you have a charged-off account like that phone example I gave you, many people with really bad credit don’t understand that $18 – they don’t care about the amount. What the credit bureaus care about is that you didn’t take care of this account. That’s what they’re most scared of.

So an $18 write-off and a $10,000 write-off, believe it or not, don’t really affect your credit all that much differently; it’s almost exactly the same thing. Some of these people, because your account gets sold from one collection agency to another, sometimes one mistake is going to put multiple dings on your credit, so you’ve got to get those things off.

A lot of these are against the law. There are laws out there to protect you, but unfortunately, most of us don’t check our credit enough to make sure that those laws are protecting us. So go on there, submit those disputes, never do more than three disputes (in my personal opinion) with any one bureau per month.

How Long Does it Take to Fix my Credit Score?

So if you’ve got a bunch of different things on your credit, go on there, go look at Experian, and then dispute up to three of them. Go to Equifax, dispute up to three. Go to TransUnion, dispute up to three, and then wait 30 days.

The beauty of it is this. The way it works when you dispute something on your credit, they will send a letter to the creditor. Maybe it was Southern California Edison – my electric company, for example. Maybe it was them, maybe it was AT&T for phone service – whatever it was – they send them a letter and say, “Hey, this person, Arman Sadeghi, is disputing this late payment or is disputing this charged-off account.”

Now that company has 30 days to respond. From the day you dispute, there’s a 30-day period. If on the 31st day they have not confirmed it, it automatically comes off your credit. That’s where the lawmakers have created some things in place to help us out.

So even if it just gets delayed because a lot of these guys are not keeping good records – that’s why, by the way, they said you had a late payment when you really didn’t. If you just submit those disputes, the onus is on them to come back and confirm it. If they can’t confirm it, it’s coming off of your credit. Get on there and do these disputes for the things that are inaccurate or anything that whatever reason doesn’t make sense.

The other thing that you can do is for a lot of these accounts, let’s say you have a charged-off account. Call them and pay it if it is real.

Call them up and just say, “Hey, I had this account with you guys. I didn’t realize I hadn’t paid it. I’d like to pay it.” Now a lot of times, they’ll even work with you and accept lower amounts, but get those things paid.

Now a late payment, there’s not much you can do about it – it’s already late. But it’s way better to have a charged-off account switch to another type of negative thing, which is nowhere near as bad, and that is that you were late but you eventually paid it.

You want to get those charge-offs off of your credit report, and if it’s wrong, you’re going to dispute it. If it’s accurate, just pay the people and it’s going to come off of your credit. Even if it stays on, again, it will look way better and it will hurt your status way less.

The key to repairing your credit is to make sure that you’re watching it all the time. Once you’ve done this enough and you’ve gotten your credit score, there are various different programs you can use where you can monitor your credit and you can even get free reports and things like that.

Or if you pay for some services, they watch it for you every month and send you emails and notifications and stuff like that if something bad happens. So protect your credit, get your credit at least to the ‘good’ rating and ideally, up to the ‘outstanding’ rating. If you can get your credit score over 700 or ideally over 750, now you have the power to do what you want.

A Recap of This Series on Finances

So in these six episodes, let’s look at what we’ve talked about, where we started, and where we are today before I send you guys off. But I’m done talking to you about finances. I don’t know, we might come back to finances. Who knows, six months from now – I’m not sure. But we’ve really covered a lot of awesome ground here.

Number one, we talked about the American Dream is dead, the American Dream is a lie. The way that you were taught that you can go get the American Dream, we talked about it not being real and not being possible.

So what we talked about is you must keep score, you must cut your expenses, and only after cutting your expenses and only after budgeting and investing your money can you go out there and try to make more money. You don’t want to try to drive that car super-fast if you don’t know how to drive it. So take it easy, stick with your current income for now. Don’t go push to try to make more money until you learn how to use it.

Now, it doesn’t take that long. Some of you are like, “But Arman, I want to start making more money.” Good, just take two days. It doesn’t take that much time to cut out a couple of Starbucks drinks and to start investing that money.

You can start an E-trade account or Fidelity account or something like that – whoever you want – for $100 is often the minimum. I don’t know what they are these days, but I know I’ve kids come to my events, get inspired, and go open a stock market account and put $100 it.

If you have a child, by the way, that might be a nice gift to give them so that they can learn how this stuff works. There are even programs out there where you can practice by doing fake stocks and things like that.

But you must get out there, you must cut the expenses, and then take the money that you get from cutting your expenses and investing it. Why?

Because saving is boring and very easy to screw up, because you just pull the money out the next time you need it or you want it for something. But investing is addictive, so get out there and invest and then you’ve got to keep score.

Become Obsessed With Your Long-Term Goals

Now, when you’ve cut your expenses, you’re investing your money, and you’re keeping score, that’s when you go out there, do everything that you can to make as much money as you possibly can make. Work hard, be obsessed with your long-term goals. But if you’re doing that, how do you know what to buy? Well, you buy assets, not liabilities. We talked about that in the second part of this series.

In the third part, I gave you some really compelling numbers and examples of how compound interest can do incredible things. We talked about the Titanium Seven Year Rule and we talked about if you can just hold off on buying something for seven years, you’re going to be able to get it for free every seven years for the rest of your life.

So if you want a boat, man, if you could just wait seven years, you can have a free boat for the rest of your life and get a new one every seven years. That sounds pretty good to me, and all you have to do is make 10% on your money. That’s nothing compared to what I’ve seen people do.

The next thing we talked about is I taught you some of the basics of how I invest in the stock market, then I talked to you about real estate. We talked about how real estate is the way that wealthiest people have built a majority of their wealth and we talked about how some business owners will fail in their business and still make money because of the real estate.

Finally, I talked to you today about repairing your credit so you can do all of this stuff. Look, these six pieces that I’ve shared with you, I know they’ve come at you pretty quickly. But I want you to understand these are the secrets to building wealth. If you apply these six things, you can make incredible things happen in your business and in your personal life.

I love you guys, I’m so glad that you’re joining me for these episodes, and by the way, if you know anyone who can gain something from these, please share my episodes with other people. Talk about them on social media, make Facebook posts, Instagram, Twitter – whatever you like to use – Snapchat. Maybe you should snap yourself as you’re listening to my podcast. I know my wife does that. Others do it as well.

But whatever you can do, please share this with other people. Let’s get even more people exposed to this content so that they can make their lives better. I’m excited that you’re joining me for this and please join me every week for our awesome episodes of this incredible podcast. And if you have questions, please submit them to me.

I love answering your questions and a lot of these podcast episodes, by the way, come as a result of people submitting to me questions that they have or things that they’re unclear on, then I just tell them, “Hey, I’m going to do an episode it.” I do an episode and they’re excited to hear about it.

So get out there today, like every other day, and always lead with your heart.